If you’ve had the idea to buy real estate as an investment and you live on the coasts, like New York (me) or in California, you’ve probably realized that prices don’t line up very well to receive the same returns you can experience in some midwestern cities. (Although at the time of this article- October 2021, many midwestern cities are going through this cap rate compression as well)

You have two options:

1. Do nothing and never own the real estate you’ve dreamed of owning

2. Find a market that works for your goals! (Choose this!)

Let’s say you start searching around for different cities you’ve heard good things about and eventually, you decide you’re going to go all in on Indianapolis, Indiana. However, you live in NYC. How can you compete with the locals who are living and breathing Indy each and every day. While it’ll certainly be difficult, I have found a few tools that can help ease the transition before you pull the trigger on your first out of state deal.

We will use the Zip Code 46260, a neighborhood in Indianapolis as an example.

- Niche.com

Niche.com is a great resource to get a high-level overview of a specific zip code from the perspective of those who would rent from you. It shows you an overall grade from A+ down to D. It even breaks down the grades for things like public schools in the area, crime, housing costs etc.

2. Google Maps

Once i see that a particular zip code has a decent grade, I’ll take a specific deal I’m looking at and plug in the address to Google Maps. I do this for two reasons: 1. See what the area looks like, types of homes surround the asset and identify any driving factors for someone to rent my property. Are there any good amenities near by like a gym, shopping, cafes etc. If you see that the only thing near the deal you’re analyzing are warehouses and industrial-type activities, it may not attract that family of 3 looking for a cozy place to take the dog on a walk.

Take your choice.

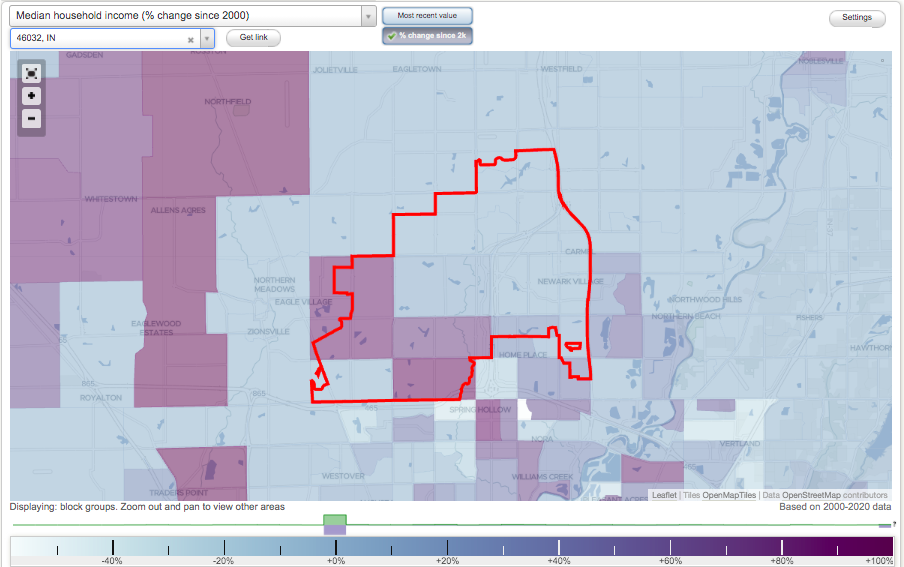

3. City-Data.com

Once I’ve gotten comfortable with the overall “vibes” of a neighborhood and submarket, I will take it to the final round of inspection to either confirm or reject my assumptions of the zip code. CityData.com is a great tool that lets you get super specific on a submarket. When you use their interactive map, you can see analytics down to a specific street! Additionally, I like to use their data on the zip code’s growth from an income and a median household cost perspective. If you’re going to invest in a market, you want to see positive trends on both facets.

Once you find the specific street of the deal you’re looking at, you can click on that area, and you’ll see specifics on the hyper-focused area.

I like this graphic for a few reasons:

- Diverse Population: The more diverse a population in a submarket, the larger your renter pool. if only one type of person lives in an area, you’re eliminating a large chunk of renter who will go elsewhere.

- Median Household income: I like a median household income between $45,000-$70,000. The reason being, if your tenant earn less, it may be tough for them to cover the rent expense if they incur a large, unexpected expense like a car breaking down or an emergency medical expense. On the other hand, if the median household income is higher than $70,000, many people may opt for home ownership rather than renting. That also affects your renter pool.

- Median Rent: I like somewhere between $600-$1000. If you have tenants paying less, i feel as the asset may not have the tenant base I’m attracting and if rents are more (depending on market obviously), then tenants may have trouble paying if they experience a sudden decrease in their income.

- Unemployment: Aim for a low percentage here, ideally around the same % as the main City you are near. If its a bit higher thats OK too, but if its astronomically higher, you want to avoid this. Unemployment means no job, which means no income to pay YOUR rent as a landlord.

While these are three tools i use to locate near markets outside my hometown, I advise you to talk to local investors, agents, property managers and vendors in these cities. They work and live in these neighborhoods and really give you a sense of what you’re getting yourself into. Maybe even make a vacation out of it and spend a few days familiarizing yourself with a new city.

If you have any other tools you use, please let me know! Jason@3pillarsrei.com