When looking at a larger multifamily purchase, you will want two documents to help you come to an offer price: the Trailing 12 (T-12) and a rent roll (aka RR). In the article, I will do my best to break down how to look through the T-12, an intimidating document if you haven’t seen one before. As you get more comfortable, this document will be come your friend and help you tackle your next underwriting session!

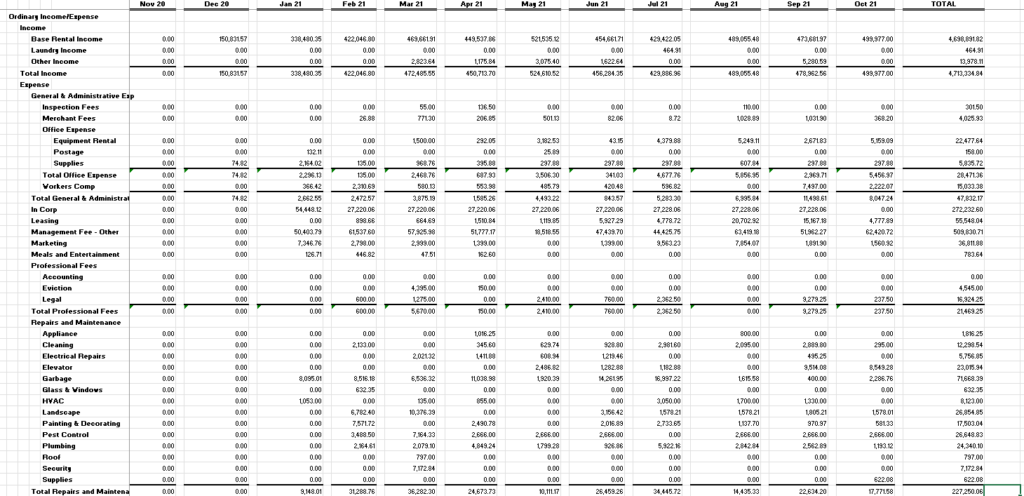

When you receive a T-12, you should see the asset’s income (on top) and expenses (on the bottom portion) broken down quite granularly to help you get a full picture of what type of money is coming in, and where money is being spent. I want to first point out, that the term Trailing 12 is referring to the previous 12 months of income and expenses, as seen from the left to the right on this document.

Upon first glance, I like to look at a high level to see if I notice any large expenses pop up through the year that come off as “unusual” or “noteworthy”. The reason I do this is to make sure I get a proper explanation from the seller or broker and make sure you are comfortable with their reasoning. If I see a large repair come up, maybe I will find out it was 5 tenants who trashed a few units and forced ownership to spend more on Capex, or maybe its a recurring yearly expense as the pipes tend to corrode and break yearly. These are issues you will need to know and budget for.

After making note of all ups and downs I notice on the document, I will make my way down to the Net Operating Income row (usually towards the bottom) and calculate the Cap Rate based on the NOI and the asking price of the asset. Sometimes a broker will advertise a cap rate that is far off once you see the full picture.

Say the NOI is $2,000,000 and the broker said the price is $40,000,000. This means the cap rate is 5%. (NOI divided by asking price gives you the cap rate). If you know that you need to buy the property at a 6% Cap to make the deal work, you can save a lot of time weeding out deals that don’t fit your box.

I want to make note that sometimes, sellers mix up regular Operating Expenses with larger Capital Improvements on their T-12. This would result in a large decrease in the property NOI, because a one time expense was put in as an operating expense, something you would likely budget for yearly, thereby hurting your offer price. BE careful to make sure all the “above line” operating expenses (meaning above the NOI) are simple operating expenses, and not large capital improvements, like a new roof or repaving a parking lot.

In a separate article, I will discuss the Rent Roll and how to understand the second crucial document when underwriting.